18 Year Property Cycle 2025. I can’t promise that knowing about the cycle will give you the degree of knowledge and mental toughness you need to. From 7.5% up to a peak of 15% in the 80’s.

As a result of rising property prices outpacing income growth, the majority of people will soon be unable to afford to own a home. Have you ever used it?

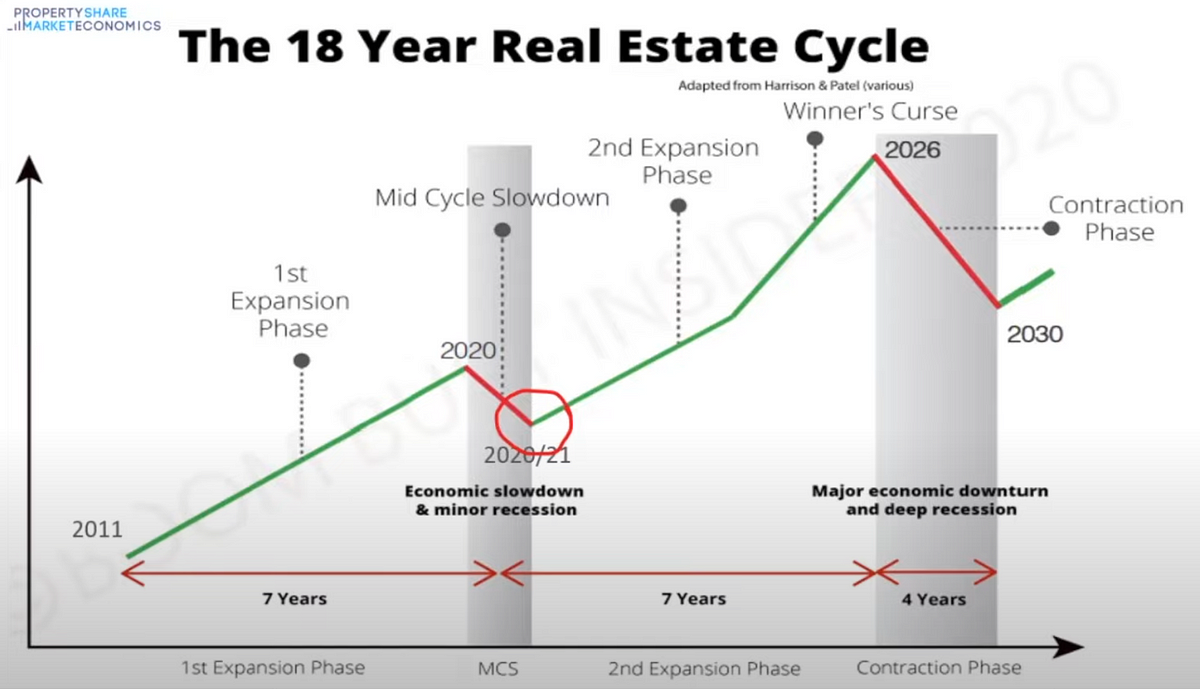

Where are we in the 18 Year Property Cycle? The Property Podcast 415, I have been researching real estate cycles and found real estate economist homer hoyt theory. How demand drives the cycle (and how this can inform your investing) where stock market prices and property prices interact;

Irish Property Market chat II *read mod note post 1 before posting, We’re now seeing a rise from a low base of 0.1% base rate, with a predicted peak of 4.75% by. How demand drives the cycle (and how this can inform your investing) where stock market prices and property prices interact;

18 Year Property Cycle Understanding the impacts ABC Dad, The how, why and what to look for in the property cycle are some of the most fundamental aspects to understand when investing in property. During this phase, property prices reach their peak, vacancy rates increase,.

What is the 18Year Property Cycle (and how can you use it to your gain, During this phase, property prices reach their peak, vacancy rates increase,. The how, why and what to look for in the property cycle are some of the most fundamental aspects to understand when investing in property.

Phil Andersons 18.6 Year Property Cycle Explained YouTube, Have you ever used it? The 18 year property cycle.

What is the 18Year Property Cycle (and how can you use it to your gain, How demand drives the cycle (and how this can inform your investing) where stock market prices and property prices interact; He analysed hundreds of years of data and found that the average length between boom.

UK 18 year property cycle and the end of the long term debt cycle. by, As a result of rising property prices outpacing income growth, the majority of people will soon be unable to afford to own a home. Recovery phase the first phase takes.

The 18Year Property Cycle and When Is Best To Invest, He analysed hundreds of years of data and found that the average length between boom. We’re now seeing a rise from a low base of 0.1% base rate, with a predicted peak of 4.75% by.

The 18 Year Property Cycle; is it a Scam, or is it Real?, From 4.5% up to 5.75% in the noughties. How demand drives the cycle (and how this can inform your investing) where stock market prices and property prices interact;

Property investor Property cycle Australian property market, But before i get to that, let’s go back to basics. As a result of rising property prices outpacing income growth, the majority of people will soon be unable to afford to own a home.

They experience a number of good years where house prices are affordable, buyers are keen to buy, banks are keen to lend and the market rises.

How demand drives the cycle (and how this can inform your investing) where stock market prices and property prices interact;